A Work of Art

One simple, majestic line compounding through time.

"The first rule of compounding: Never interrupt it unnecessarily." – Charlie Munger

Three years ago, when three trillion in stimulus spending tangled with broken supply chains, inflation awoke from its decades-long slumber and rocketed higher by 5% in 2021 and 8% in 2022. After responding slowly, the Fed moved forcefully, hiking interest rates between March 2022 and July 2023. The magnitude wasn't unprecedented, but the pace was.

In response to these shifts, market participants reacted swiftly, underscoring a familiar tension between short-term fear and long-term opportunity. Markets did what markets do. In the first ten months of 2022, the U.S. equity market1 dropped 25%, and the bond market2 dropped 16%. Then, once again, markets did what markets do—for reasons not apparent, indices turned upward, barely looking back. Since bottoming, equities are up 65%, notching 43 all-time highs, and bonds have regained 14%.

Markets typically front-run good news, and there is much to like. Corporate profits are up, unemployment remains low, inflation has dropped into the 2.5% range, and the Fed has reversed course and initiated an easing cycle—cutting interest rates by half a point.

Yet investors remain on edge—we must look no further than a midsummer flash correction. If you were vacationing with the kids before school started back up, you might have missed it.

From July 15th through August 5th, the S&P dropped 8.5%, while the tech-heavy Nasdaq fell 10%. The deepest losses came over a Thursday-Monday stretch from August 1st to 5th. The drop was worse outside the U.S. as Japan’s Nikkei Index lost 18%—its worst two-day decline in history.

Market drops are never easy, especially when they’re fast. Nerves fray. Worries abound as investors wonder, “Something bad is happening. What should I do?” If investors aren’t careful, they’ll slip up and interrupt the compounding. Fighting off the emotional urge to act is the primary responsibility in an investor’s job description.

Unfortunately, many investors fell short this summer.

According to Alight Solutions, the third-biggest 401(k) recordkeeper (behind Fidelity and Empower), trading activity in retirement plan accounts reached eight times normal on August 5th—the day the sell-off bottomed—with heavy flows out of equity funds and into money market and bond funds.

Then, as if right on cue, markets did what markets do, and the correction ended as fast as it started. Indices regained the lost ground over ten days. For the Nasdaq Index, it was the fastest recovery from a 10% correction ever.

With tens of thousands of participants in Alight’s retirement plan base, somewhere in the population is a 40-year-old with a $250K equity position who sold after the 8% drop and locked in a $20K loss when the market hit bottom.

Full of regret and bewildered, the 40-year-old investor likely followed other compounding interrupters and started bargaining internally—telling himself to wait for the market to drop again so he could buy back in and erase the unforced error from his memory.

It almost never works. Days turn to weeks. Weeks turn to months—anxiety rising every day to the point of capitulation when buying back in higher becomes the only relief. Assuming this was the plight of our 40-year-old, his damage is far worse than a $20K loss.

Why?

The loss compounds over his lifetime.

Ugh.

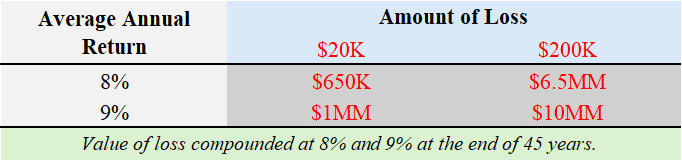

If our 40-year-old lives to his actuarial life expectancy (another 45 years) at 8% compounding, a $20K loss turns into a $650K loss. At a 9% average annual return, closer to historical equity averages, the pain grows to $1MM.

Over a lifetime, the implications are staggering.

"Permanent loss of capital in a well-diversified portfolio remains a purely human accomplishment, of which the market itself is incapable." – Nick Murray.

A short Uber north of Wall Street, The Metropolitan Museum of Art houses 1.5 million works in seventeen curational departments. The Met might be best known for its collection of 19th-century European paintings by the Old Masters: Van Gogh, Monet, and Cezanne. Locals spend their lives taking in the magnificence.

What The Met doesn’t have, nor ever will, is a wing dedicated to investing. If it did, the busts of two Old Masters of Investing, Warren Buffett and Charlie Munger, might adorn the entrance to honor the compound returns they’ve generated for Berkshire Hathaway investors.

It might also be fitting if The Met’s non-existent wing featured a mural of the S&P 500 growing through time.

One simple, majestic line, compounding upward, showcasing the energy of human ingenuity delivered through capitalism.

A magnificent work of art—masterful in its own right, surely holding its own.

Standing back, gazing at the beauty, visitors could pick any starting point followed by a point twenty years later and contemplate the life-changing returns. Moving closer, they would see the jagged drops and occasional jaw-dropping declines that would bring to mind corresponding world wars and pandemics, tech bubbles, and terrorist attacks. Or, looking more deeply, they might recall tightening cycles and tax changes, banking crises, and budget deficits.

Distress, anguish, or discomfort might resurface if the visitor were an investor. Maybe their palms would sweat as they recalled the temptation of an internal whisper, “Just once, move to the sidelines until the coast looks clear.” Or a panicked shout, “Sell now!”

Like our 40-year-old investor this past summer, some might wince, recalling their reaction, giving in to the temptation and interrupting the compounding. Others might remember their ability to surrender during the pullbacks, the corners of their mouth turning upward, as they pinpointed precisely when the market resumed its permanent march higher on the one simple and majestic line before them.

You can’t be an equity investor and not be tempted. It goes with the territory.

Temptation doesn’t just show up in corrections and bear markets. It sneaks up, even at all-time highs, when investors think the market is sure to drop. It arrives like clockwork every two years in the form of elections.

Unforced errors lurking as political beliefs.

We’ve been convinced that bad things are in store for our investments if the “other party" occupies the Oval Office or controls Congress.

Despite what we’ve heard in the news, despite our political lens, and despite what our gut is telling us, it’s not true.

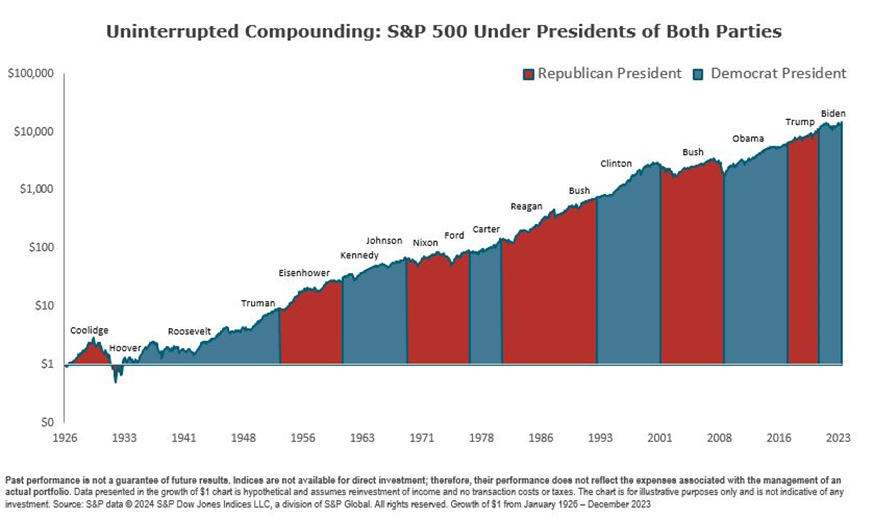

If the mural in the non-existent wing at The Met were painted in presidential colors, it would look like this:

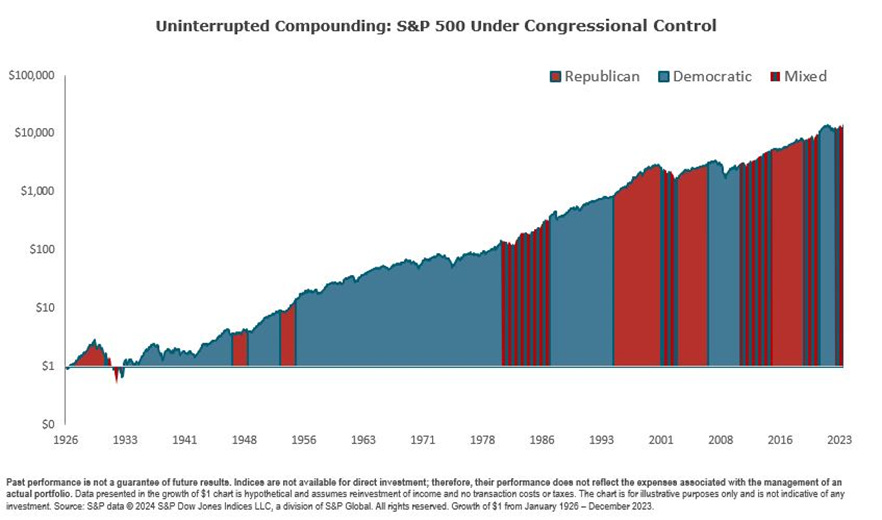

And if the mural in the non-existent wing at The Met were colored by Congressional makeup, it would look like this:

Brushed in red, colored in blue, or painted in a blend of both, the market’s upward trajectory persists regardless of who is president, independent of who controls Congress.

One simple, majestic line advancing through time.

With investing, the collaboration of humans and ideas to create goods and services for customers—and profits for owners—triumphs over political positions, policies, and parties. It’s not that politics aren’t important. But in the context of your portfolio, the economics of innovation, ingenuity, and business creation matter more.

Your investment portfolio is more than just a collection of assets—it is a self-portrait of hard work, saving, disciplined investing, and emotional fortitude in navigating market cycles. Sometimes, that means avoiding unforced errors, like turning a $20K drop into a $650K regret. More often, it means identifying $20K opportunities that grow into $650K of time-optionality and flexibility.

For many, the art of a meaningful life is found in relationships and deep connections with others. Ultimately, the art of investing is not dissimilar; it's about staying in relationship—connected to the compounding.

Resist the temptation to disconnect. Stay the course, remain an owner. One day, you will look back at your portfolio, behold the simple, majestic line that has compounded upward through time, and say, “Oh, my! What a magnificent work of art.”

1S&P500 Index

2Bloomberg Barclays U.S. Aggregate Bond Index

Thank you for reading. Please share if someone would enjoy the essay, or reach out directly if you like. We help clients stay connected to the one simple, majestic line compounding through time.

Great essay James, always excited to see a new piece from you in my inbox. I’ve read a lot on investing - from Graham to Buffett to Lynch to Malkiel - and your ability to describe complex financial topics in simple, easy to understand ways is on par.

Reading this, I found myself thinking of the parallels of the Hero’s Journey. Not identical, but the hero being reluctant to set out on the Road, meeting unexpected friends and foes, riding through highs and lows, euphoria and despair and several moments they want to quit and turn back but realize they cannot or else they’ll never become the person they want to be.

Dear James,

An excellent reminder! Do you remember our conversation in 216 before the Clinton/Trump election? I remember sitting in my home office talking with you about my market concerns with the upcoming election. You gave me the same advice as in this post, albeit without the pretty charts. I took your advice to heart and have followed it ever since. I will continue to hold the course and if there is a correction before or after this upcoming election, will consider it an opportunity for dollar-cost averaging. Your thoughtful knowledge-sharing has been integral in the success of my retirement investment strategy. Thank you for that, and for today’s reminder!