Will I Be OK?

Looking inward vs. outward

Jane walked into the office with a smile on her face as usual, but there was something different this time. I couldn’t quite put my finger on it. Like her smile was half-hearted. The gleam in her eyes that accompanies joy was absent. It was as if she was looking past me.

As she moved to take a chair at the conference table I asked, “Is everything OK?”

She looked up and held her eye contact this time, “Will I be OK? My portfolio is down 30%. It just seems there is nothing to be hopeful about these days. I feel anxious.”

I appreciate your candor, I said to Jane as we sat down. It’s important. I would never presume to know what’s on your mind or how you’re feeling.

“Thank you. I feel a bit relieved just telling you how I feel.”

Jane, my answer is, Yes, I think so. And I want to tell you why.

“Please do. If you can’t tell, I need a pep talk.” Jane sat back and relaxed a bit.

Let’s start with what you can only see if you’re looking with a broad lens: Human ingenuity and the process for owning it.

Every day eight billion people around the world wake up and engage in economic activity as they live out their choices and seek to improve their standard of living. At least half go to work, creating value in the form of products and services. All that economic activity propels the world forward and moves standards of living upward.

The depth of ingenuity is startling: The wheel, electricity, the steam engine, the combustion engine, automobiles, air travel, the computer, the internet, most recently the iPhone.

Human ingenuity hasn’t ever stopped, not for wars, terrorist attacks, or pandemics. It endures through time.

Jane, you participate in this marvelous ingenuity by owning little slivers of thousands of companies across the globe.

When you hear the word “stock” – that’s just another word for ownership in a company.

Accumulating wealth, at its core, is as simple as participating in the fruits of human ingenuity through ownership – whether it be your own business or someone else’s business.

An example of ingenuity at work was the creation of the “mutual fund”, an ownership structure that allows you to own the companies at almost no cost.

Billions of people, inventing and working productively on behalf of you, their owner.

The rewards of ownership are extraordinary.

You’ve probably heard the parable of the investor who puts $100,000 in the market, falls asleep, awakens 25 years later, and finds it’s worth $1,000,000. A 10X return.

Albert Einstein once described compound interest as the “eighth wonder of the world,” saying, “he who understands it, earns it; he who doesn't, pays for it.”

The problem is that we’re not asleep. We’re awake.

When you own companies, lots of them, you become vulnerable, opening yourself up to temporarily parting ways with your hard-earned money. leading to feelings of panic, fear, and doubt.

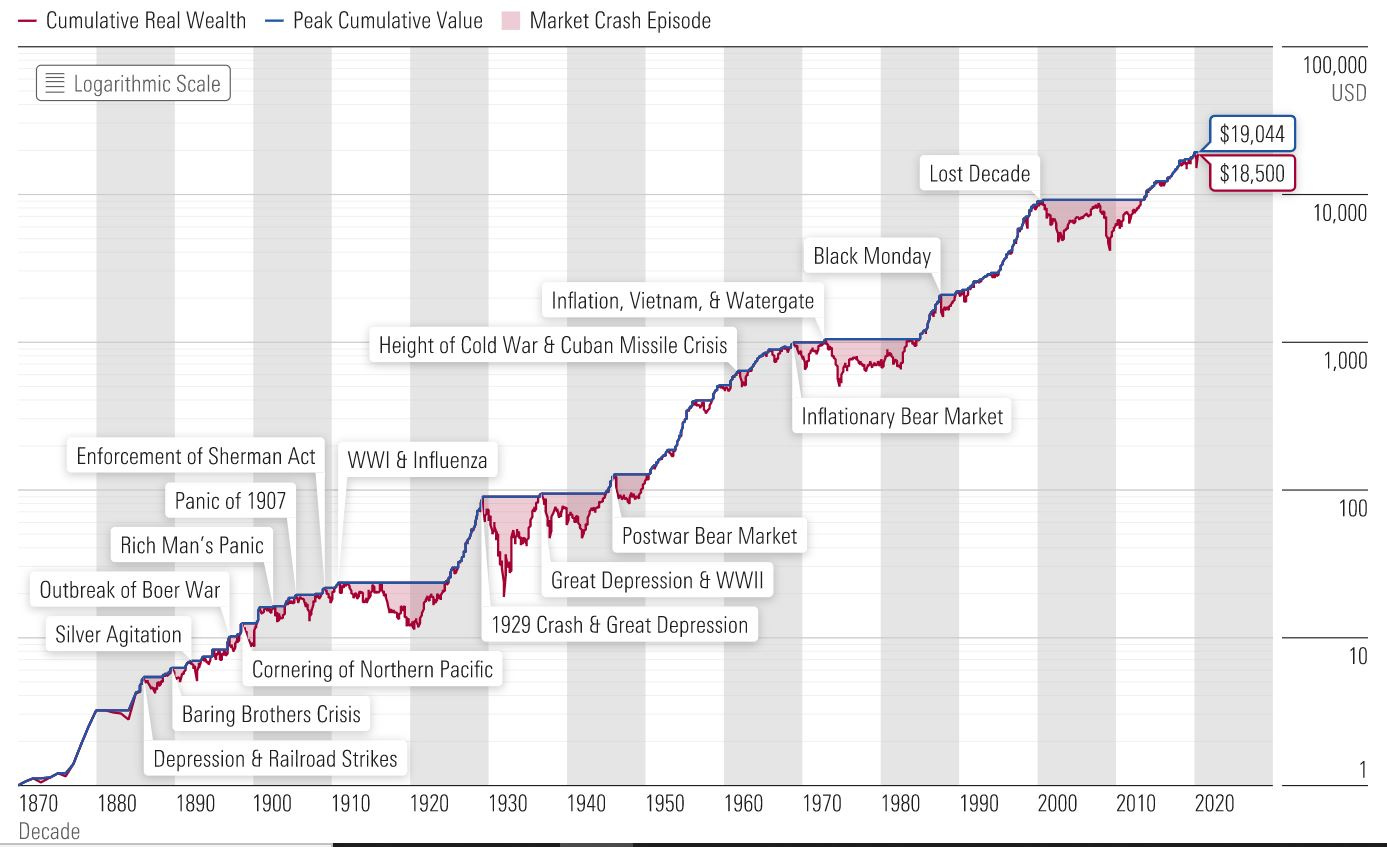

On average, every year the stock market falls at least 10% at some point. Every three years it falls at least 20%. Every five years, 30%. Every ten years, 40%. Twenty-six times in history, the market has dropped more than 20%, bear markets as they’re called. Twenty-seven times, the market has gone on to make new highs.

“Every day I wake up, want to sell, stick my head in the sand, and hang out until the coast looks clear. Then buy back in.” Jane said.

I know – these temporary drops evoke fear and lead to feelings of helplessness and doubt. At times like this investing feels dangerous and humans are innately wired to flee danger and minimize pain vs. staying with discomfort.

When it comes to investing, it’s ever so important to not disrupt the compounding. Lucky for the asleep investor, huh?

Jane, the antidote to the fear you’re feeling right now can be served by three virtues you already have, and I’d like to help with.

“Oh? Do tell,” Jane cracked with a wry smile.

Thatta girl. I’d be glad to.

The first is Faith.

Merriam-Webster defines faith as a belief in something for which there is no proof. You walked in and said that it seemed there was little to be hopeful about.

If you could peek inside the boardrooms of all the companies you own and see the new products and services they will introduce in the next ten years, you’d probably be so excited, and full of hope, that you’d borrow money from your friends to invest.

It doesn’t work this way. You don’t get to see what’s coming in the future from all the human ingenuity at work today.

That’s the paradox. With any new dollar you invest today you’re buying what cannot yet be seen. Or if you’re simply holding on to your ownership today, it’s not for today’s products and services, it’s for next year’s, and the year after that.

The market fall during the great recession started in October 2007 and bottomed in March 2009, eighteen months later. It was a harrowing time. It's worth remembering that once the market started climbing off the bottom, a diversified portfolio had fully recovered its loss 19 months later in October 2010.

In March of 2009, there was no proof of anything good on the horizon.

Faith is also essential when markets are rosy. Fast forward to the spring of 2013. The market notched a new record high, and everyone was saying it couldn’t keep going up. It proceeded to advance 90% over the next five years.

Martin Luther King Jr. says, "Faith is taking the first step when you don't see the whole staircase."

The second virtue is Patience.

Jane shifted in her chair. Feeling a bit impatient, Jane?

“Ha. Yes, a little,” Jane said with a sparkle in her eye.”

Famed investment manager Peter Lynch said: “It’s not the smartest investors that will endure, but the most patient. In the stock market, the most important organ is the stomach. It’s not the brain.”

Humans by nature are impatient.

We want to microwave returns. Some try this by speculating on a single stock, or something like bitcoin. You could become spectacularly rich if you’re lucky. Problem is that you can also go bust.

Did you know that Warren Buffet generated 90% of his wealth after turning 65. When asked what his secret was, he said, “Getting rich slow.”

You can’t reliably get rich quick. You can reliably “get rich slow” by sticking with your process, looking inward, and managing your emotions.

The third virtue is Courage.

Author and theologian CS Lewis wrote, "Courage is not simply one of the virtues but the form of every virtue at its testing point.”

Being awake means being constantly tested.

Those bear markets we talked about earlier - those are investors panicking. They’ve lost sight of the unseen ingenuity that will manifest itself down the road. It is this very ingenuity that will power your portfolio back to all-time highs in time.

It takes courage to maintain your faith when you can’t see it, and patience to wait for it.

“I feel better, said Jane. You’ve given me a lot to think about. While I still feel agitated a bit, I’m able to see how I need to shift the way I relate to what’s going on, rather than wish reality was different right now.”

Yes. When you argue with reality, you lose 100% of the time.

Thank you for being open-minded and coming in today. It’s a pleasure to work with you.

I’d love to know what you might think the percentage of investors who HAVE the 3 fold vision you speak of VS those who are either misinformed or only want the microwave outcome.

My husband does the investments and as we near retirement I’m getting more interested in what is actually happening in the world of the markets.

Cheers!

Thank you, James! There is something so uplifting about sharing ownership of Human Ingenuity in the Market. Like riding together in a Big Boat on the ocean of Change, rhythmically sloshing one way and another. You can ride anywhere on that boat, risking the random gust of wind and spray in the bow, but getting the best view of the future. Or you can tuck in on the main deck close to the mast, out of the wind, and share a cup of tea without spilling. Right now, a year after you wrote this, some of us humans are testing out the idea of going to war as a means to an end. Yet again. Sure enough, violence is a failure of creativity, and those of us watching from the Big Boat can contribute our faith, patience, and courage while the experiments play out. Human Ingenuity will weather this storm, yet again. We'll be OK, slosh after slosh...